Optimus Capital

Bridge Loans

Approaching Our 10 Year Anniversary

With our extensive experience, Optimus Capital has developed a deep understanding of the real estate market and the unique needs of borrowers. We have honed their ability to assess the value and potential of properties, enabling them to make quick and informed lending decisions. This expertise allows Optimus Capital to fund loans in a matter of days, providing borrowers with the swift financing they need to seize opportunities or overcome financial hurdles.

Optimus Capital

Empower Your Real Estate Ventures with Optimus Capital's Bridge Loans

Why Choose Our Bridge Loans:

- Agile Financing: We recognize the urgency in seizing lucrative opportunities. Our streamlined process ensures rapid approvals and funding, empowering you to secure profitable deals swiftly. Our programs are ideal for those looking for short-term real estate loans to move fast on competitive opportunities.

- Tailored for Success: No two investments are alike. Our bridge loans are customized to match your project’s unique requirements, providing flexible terms and structures to suit diverse real estate endeavors. We frequently work with investors seeking investment property bridge loans that align with their long-term strategies.

- Expert Guidance: Backed by seasoned professionals with comprehensive expertise in real estate investment, our team navigates the complexities of bridge financing, ensuring astute guidance at every step. This includes support for commercial bridge loans on multi-unit and mixed-use properties.

- Transparent and Reliable: Trust forms the cornerstone of our relationships. Experience transparent communication, ethical dealings, and a reliable partner committed to your success from initiation to closure. Our team also offers insight into residential bridge loans for individual property transactions.

Why Would Someone Want a Bridge Loan?

These types of loans are meant to be more “flexible” than traditional bank loans and to provide a “bridge” from the time the property is acquired to the time it’s sold or “exited.” Sometimes these loans are called bridge loans for real estate because they are short term loans that help a real estate investor purchase a property with less out-of-pocket costs than using all of his or her own capital. These loans are more flexible and are designed for these types of transactions. Most of the time rehab or renovation funds are given to the borrower.

Our Raving Fans

Check out the reviews from our satisfied clients

Optimus Capital

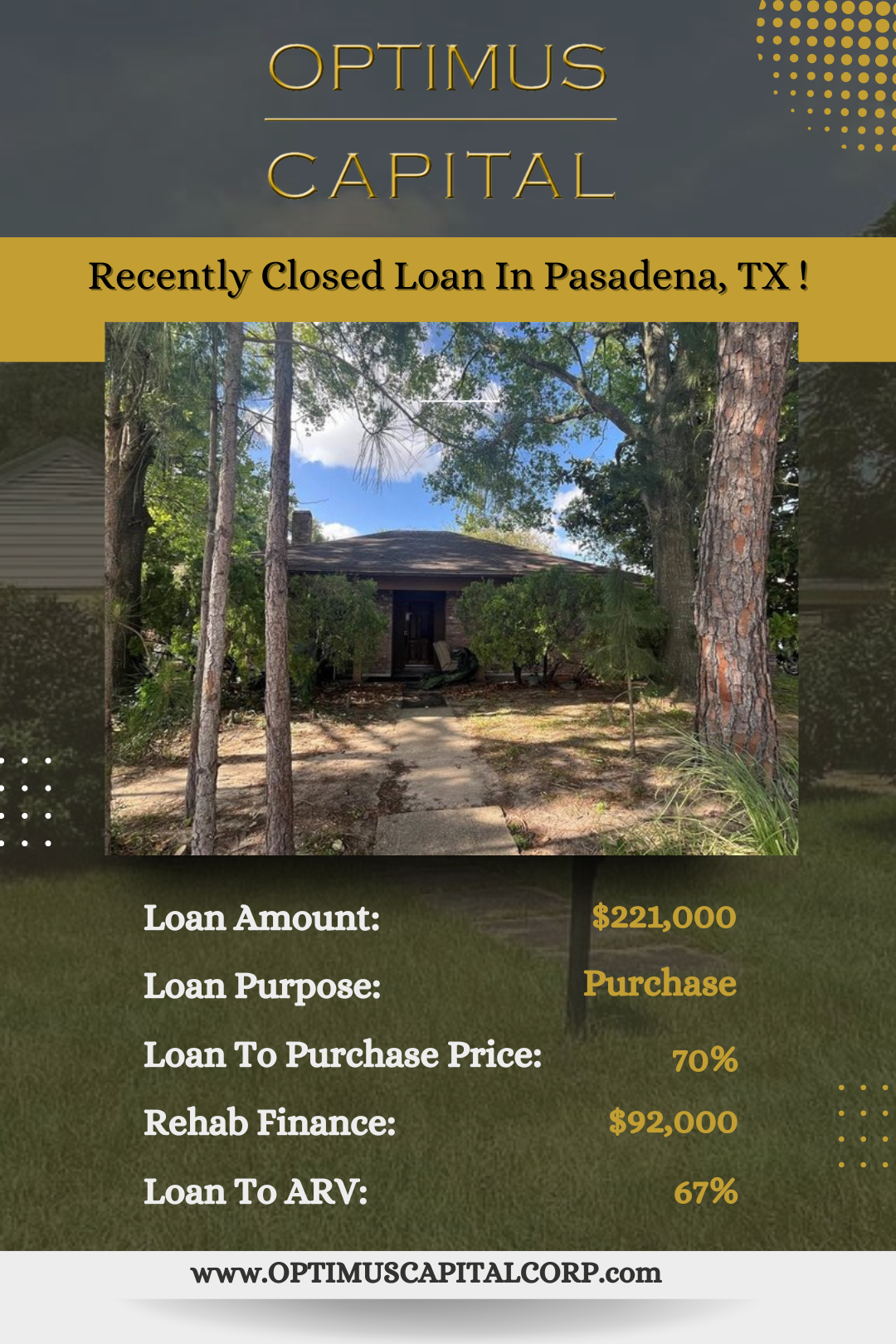

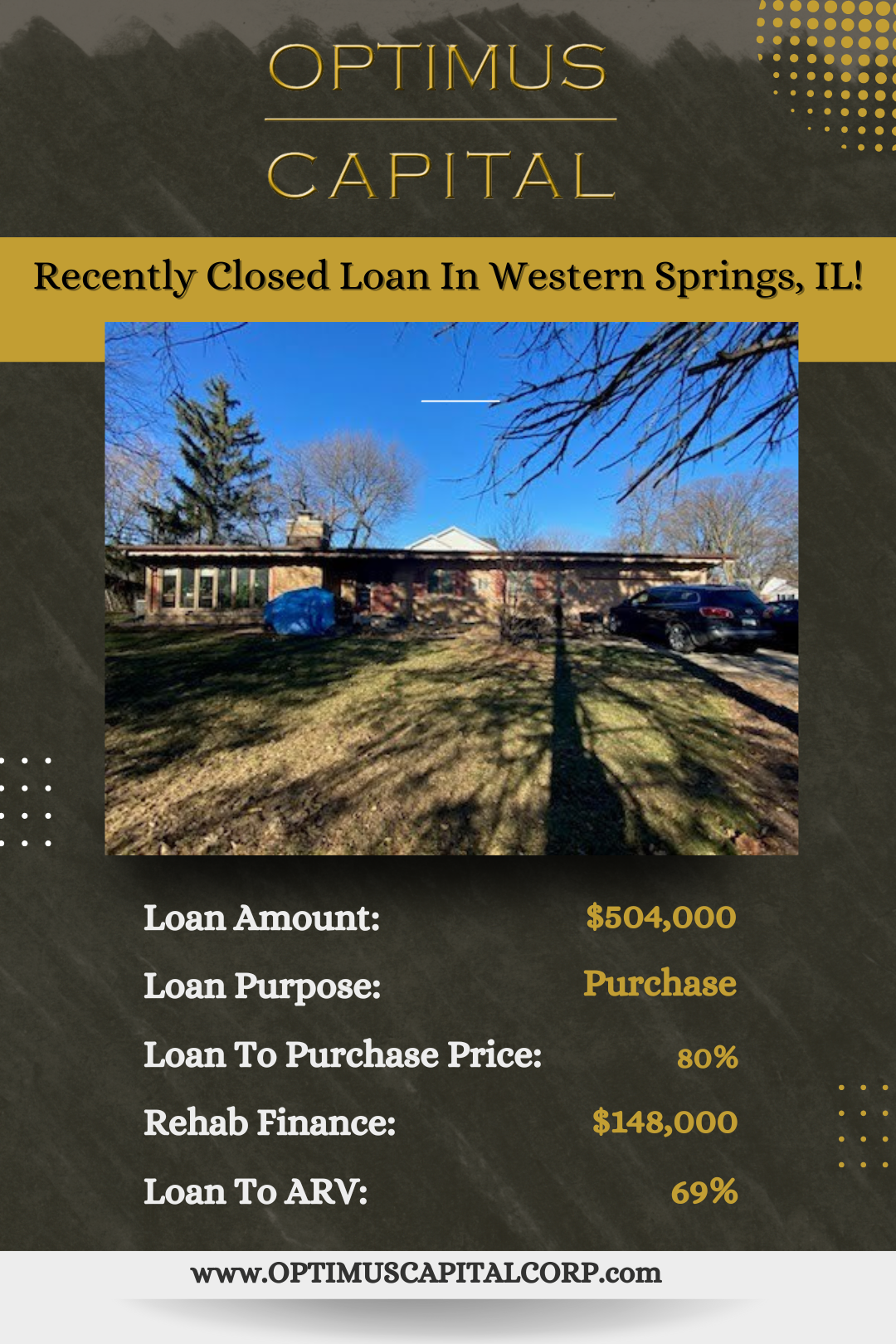

Recently Closed Loans

Location: Nationwide

Bridge Loans For Investors

Optimus Capital bridge loans allow borrowers to purchase, finance, and acquire solid single family property deals which they intend to remodel the properties. Optimus Capital allows them to save money with lower interest rates and reduced fees.

Optimus Capital bridge loans work by allowing flexibility, lower rates and higher rates of return because of our institutional level investing and customer-centric investor mindset. The more money we can save you in finance charges, the more you have to invest.

Our Founders, being real estate investors, understand that when an investment opportunity presents itself that capital is necessary and we want to empower you. Optimus Capital Loans give you the flexibility with excellent terms, often lower than what’s offered by many lenders.

Optimus Capital is a full-service direct bridge loan lender and we can streamline all your Single Family Loans to assist you in building your real estate portfolio.

We are here to assist you with a bridge loan during this time. We are still closing on loans during COVID-19. Our team is working diligently daily to assist our borrowers. We look forward to closing your deals quickly and efficiently during this time.

How Does a Bridge Loan Work?

Let’s continue using our example from above. Let’s say the total amount needed to remodel or “rehab” the property will be $35,000. Usually the bridge loan lender will give 100% of the rehab or renovation funds. But, what does that mean? Does that mean that they will give all of the renovation funds upfront? No.

The rehab or renovation funds are usually based on “completed work.” Meaning the real estate investor starts the work or remodel. Completes some work. Pays for it out of pocket first. Then requests a “draw.” The work is usually inspected by a third party. This third party company then issues a report with photos to the bridge loan lender. Then the amount of the draw is usually wired to the borrower. The real estate investor then continues the remodeling process and requests another draw or draws by repeating the same process.

These bridge loans are based on the value of the property. A loan-to-value or LTV is given against the property. Personal credit and track record or relevant experience are determining factors when a bridge loan lender decides to offer “terms” to the borrower. The borrowers personal credit isn’t as much of a determining factor when deciding if a borrower will be approved for a loan. The personal credit of the borrower is usually a guiding factor. The personal credit can affect the “rate” or interest rate that the borrower receives.

These types of loans are very common for “flippers” also known as “house flippers”. Real estate investors who usually purchase a single family home ranging between one to four units on average. They acquire a SFR or single family home that is distressed or needs remodeling. These house flippers then remodel the property and sell for market price once the remodel is completed. This is the reason why the industry standard length of time for these loans is usually 12 months. This gives the “flipper” time to purchase, renovate the property, and then sell.

When an investor flips a house he or she is willing to pay a higher interest rate for the use of this type of loan because the terms for this type of loan benefit the borrower. The flexibility of a bridge loan can assist the borrower with purchasing, completing the renovation, and selling the property. These types of loans also require a lot less paperwork than traditional bank loans.

An important part of the success for many real estate investors is for their lender to close quickly. Many times finding a great deal requires the investor to close on the property quickly. This is where these types of loans come in. It allows the borrower to acquire the property quickly and to use less if his or hers own capital to do so. The Loan to Value or LTV given by bridge loan lenders varies. Usually it is somewhere between 70 to 90% of the purchase price.

The determining factors which can affect the LTV or loan to value given would be the real estate investor’s past “proven” experience in flipping properties. Meaning how many past flips has a borrower completed and “when” where they carried out. Another factor that can determine the amount of capital the lender will give is the borrowers personal credit score. For example a borrower who has flipped 10 properties and has a mid credit score of 680 would usually receive a higher loan to value or LTV than someone who has never completed a flip and has a personal credit score of under 600.

Bridge Loan FAQs

What is a bridge loan from Optimus Capital?

A bridge loan from Optimus Capital is a short-term financing solution that helps real estate investors quickly purchase or refinance property before securing long-term financing or selling another asset.

When should I consider using a bridge loan?

Bridge loans are ideal when you need quick funding to secure a new property while waiting for another one to sell or refinance. They are commonly used by real estate investors and developers.

How fast can Optimus Capital close a bridge loan?

Optimus Capital can close bridge loans in as little as 5 to 10 days, depending on the deal structure and provided documents.

What do I need to apply for a bridge loan with Optimus Capital?

You’ll need a property address, project details, your experience level, and a clear exit strategy. Our team helps streamline the application process.

Can I get a bridge loan without perfect credit?

Yes, Optimus Capital focuses on asset-based lending, which means we can often fund deals even if your credit isn’t perfect.

What are the typical terms for a bridge loan with Optimus Capital?

Bridge loan terms usually range from 6 to 12 months, with interest-only payments and flexible options based on your project and market.

Does Optimus Capital offer bridge loans for both residential and commercial deals?

Yes, Optimus Capital provides bridge loans for both residential and commercial real estate projects in multiple U.S. markets.

Where can I find flexible bridge loan options in Sacramento, California?

Optimus Capital offers flexible bridge loan options in Sacramento, California, with fast closings and low rates that support local real estate strategies.

Who provides quick bridge loans in Miami for property investors?

Optimus Capital offers fast bridge loans in Miami, Florida, designed for investors who need immediate funding to secure or reposition property.

Are there lenders in Texas offering bridge loans without long processing times?

Optimus Capital helps Texas investors close quickly with streamlined bridge loans, serving cities like Austin, Fort Worth, and Dallas.

What are my bridge loan options in Ohio for short-term real estate needs?

In Ohio, Optimus Capital provides short-term bridge loans for investors looking to buy or refinance quickly, with terms that fit time-sensitive deals.

Which lenders offer bridge loans in Los Angeles with competitive rates?

Optimus Capital offers competitive bridge loan rates in Los Angeles, California, and helps investors close quickly on new opportunities.

Can I find fast bridge loans in Colorado for a commercial purchase?

Optimus Capital provides commercial bridge loans in Colorado with quick closings and flexible repayment terms for active investors.

Are there real estate lenders offering bridge financing in Hawaii?

Yes, Optimus Capital offers bridge financing in Hawaii with fast turnaround times, helping local and out-of-state investors act on urgent deals.

Is there a lender in Washington state with low-rate bridge loans?

Optimus Capital offers low-rate bridge loans in Washington, helping investors in Seattle and other cities move quickly on transitional deals.

What are the options for bridge loans in Georgia for investment properties?

Optimus Capital supports Georgia investors with fast bridge loan solutions, ideal for transitional real estate projects in cities like Atlanta.

Who provides investor-focused bridge loans in San Diego?

In San Diego, Optimus Capital offers investor-focused bridge loans with competitive rates and fast closings, designed for real estate professionals.