90% Hard Money Loans

Approaching Our 10 Year Anniversary

Optimus Capital is backed by institutional level investors which allow us to reduce the cost of our residential property loans compared to other hard money lenders. We pass the savings on to you with lower interest rates and fees in order to maximize the benefits that we offer to you. In building a strong relationship with us, our hopes are that you come back to us for financing your complete rental portfolios and allow us to save you money on all of your current and future investment.

The benefits of using a firm like Optimus Capital means that the best hard money loans available will be presented to each of our borrowers. Our Founders, being real estate investors, understand that when an investment opportunity presents itself that capital is necessary and we want to empower you. Our hard money bridge loan gives you the flexibility with excellent terms, often lower than what’s offered by many hard money lenders.

Optimus Capital is full-service and not like other hard money lenders. We can streamline all your hard money bridge loan transactions to assist you in building your real estate portfolio by accessing the best hard money loans possible.

built on trust

90% Hard Money Loans

We at Optimus Capital work tirelessly so that our borrowers receive the best hard money bridge loan possible. We are not like other hard money lenders. Having purchased hundreds of properties ourselves; we under the unique needs that each real estate investor has. We have encountered nearly every possible situation and outcome in our deals, therefore we hold a wealth of knowledge and experience to pass on to our real estate investor clients.

Our terms range from 12 months to 30 years. It’s easy to get started. Our dedicated team will work efficiently and diligently to answer all of your questions and bring an excellent solution for the type of deal that you are looking to get funded.

In addition to our expertise, Optimus Capital prides itself on its commitment to customer service. We understand the importance of clear communication, timely responses, and personalized attention. Borrowers can rely on our dedicated team to provide ongoing support and guidance throughout the loan term, ensuring a positive experience from start to finish.

As a hard money loans expert with 10 years of experience, Optimus Capital has solidified its position as a leader in the industry. Our deep understanding of real estate, quick turnaround times, and commitment to customer satisfaction have earned us the trust and loyalty of borrowers across various markets. When it comes to nationwide hard money loan financing, Optimus Capital is the go-to source for individuals and businesses seeking reliable and efficient lending solutions.

Optimus Capital

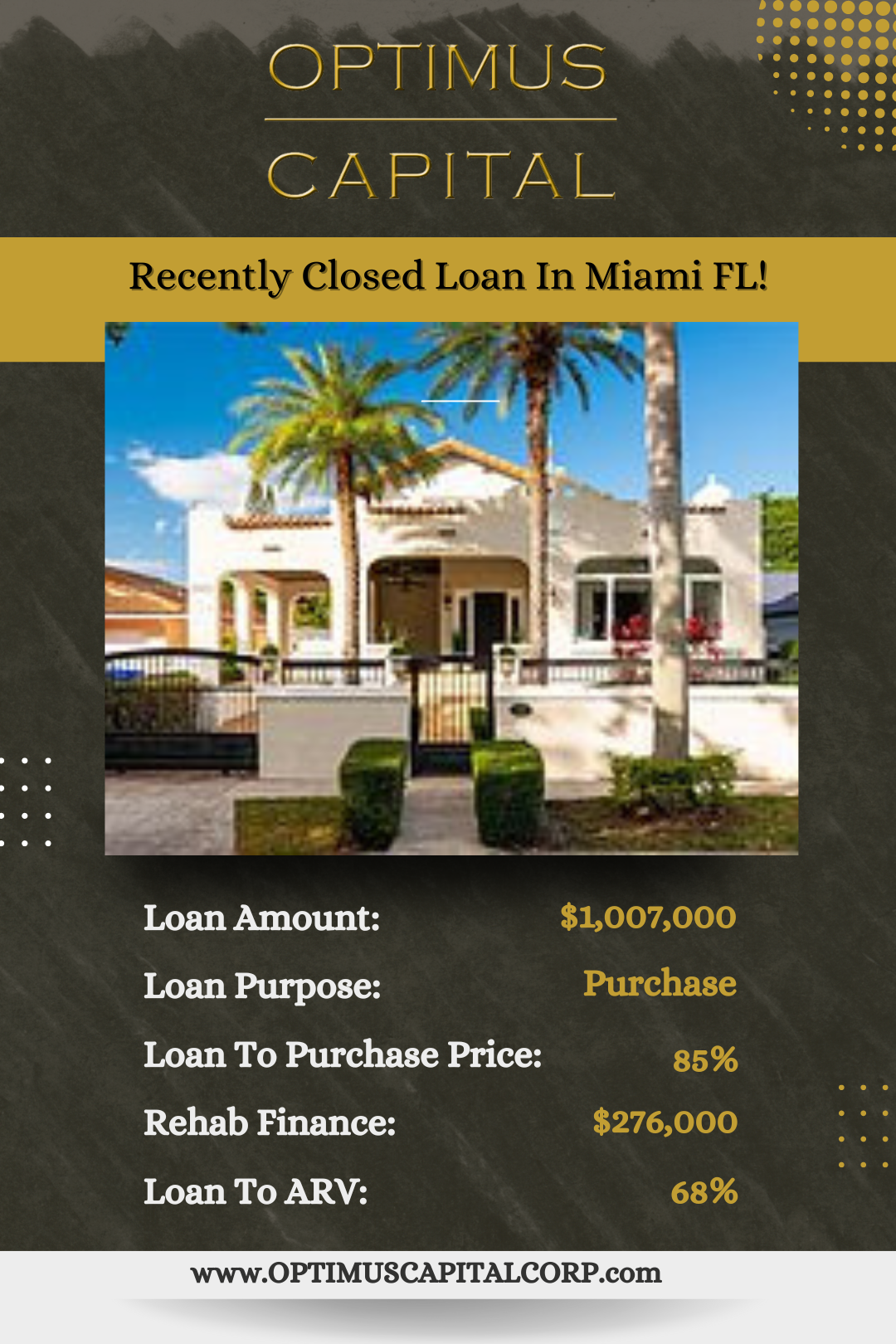

Recently Closed Loans

Optimus Capital, provides loans for individuals, corporations, LLC, and trusts. All of the property’s that we fund are “non owner occupied” meaning investment properties only. We at Optimus Capital are available by phone, email or text. We are looking forward to a mutually beneficial long-term relationship with you and your team. Click here to apply now

Our 90% of purchase price hard money loans provide real estate investors a bridge loan access to capital for a short period of time. Usually this period of time or “term” is between 12 to 24 months. A hard money bridge loan from us can be used to purchase or refinance a single family home which is non owner occupied. This means that the property is or will be acquired as an investment property. Learn more about our Investment Property Loans here.

We strive to be one of the top hard money lenders in our space. We have designed our company and programs with You in mind

90% LTV Hard Money Loans Vs. Traditional Bank Loans

Real estate investors who know when to access 90% hard money loans get the best return on their money and spend the least amount of money on each project. A hard money loan is used to fund the majority of a real estate purchase that the borrower plans to resell soon.

In many ways, a hard money loan differs from a regular mortgage. A hard money loan is primarily supported by the asset being acquired, rather than the borrower’s standard underwriting technique. This is ideal for house flippers with unusual incomes or who are borrowing money.

Traditional mortgages have substantially longer periods than hard money loans. While a traditional home loan is for 30 years, hard money loans are often for 6 to 18 months.

Hard money loans have higher interest rates than standard mortgages. This is because the loan is designed for short-term real estate investors who do not want to meet the criteria for a standard mortgage, instead of owner-occupied long-term primary residences.

Optimus capital

When To Utilize 90% LTV Hard Money Loans

Traditional investor financing is a possibility for house flippers, but it demands a 20% down payment. Using a 90% hard money loan implies the borrower just has to put half as much money into the project as they would with a traditional loan. This is ideal for people who are working on many house flipping projects at the same time or who are short on cash but don’t want to lose out on an opportunity. A 90% hard money loan is a fantastic solution for house flippers and real estate investors who are working on a tight deadline and don’t want to put too much money into a property.

Get started today

Hard Money Loans For House Flipping

Getting a hard money loan presents a significant opportunity for investors nationwide, given the current market conditions.

With a hard money loan, investors can quickly secure the necessary funds to capitalize on lucrative investment opportunities, such as purchasing distressed properties, renovating and flipping houses, or acquiring undervalued assets. The speed and flexibility of hard money loans enable investors to act swiftly in a competitive market, giving them a competitive edge. Optimus Capital Inc.’s nationwide hard money loans allow borrowers to purchase, finance, and acquire solid single-family property deals in which they intend to remodel the properties. Optimus Capital Inc. allows them to save money with lower interest rates and reduced fees.

Optimus Capital Inc. allows for flexibility, lower rates, and higher rates of return because of our institutional-level investing and customer-centric investor mindset. The more money we can save you in finance charges, the more you have to invest.

TESTIMONIALS

We’ve helped Hundreds of investors nationwide secure Hard Money loans

Don’t just take our word for it, check out the reviews left by some of our happy clients.

Vladimir

Google Review

“I am experienced commercial real estate investor and this is my second transaction with this broker. I had some challenges with my loan and they handled it very professionally. Briana did follow up with me on every step of the process. Will definitely use them again.”

Peter

Google Review

“They’ve done three loans for me now, and each time they’ve been great! Very diligent and attentive, and they make the process go so smoothly. I also feel like they’re always taking an extra step to make sure my deals go well for me. These are my go-to people for loans!”

Alex

Google Review

“My experience was extremely positive. Their professionalism, expertise, customized solutions, efficiency, transparency, and outstanding customer service set them apart from other construction loan providers. I would highly recommend Optimus Capital Inc. to anyone seeking financing for their construction projects.”

A nationwide leader in Hard Money loans

Are you ready to seize the opportunities that hard money loans can bring to your investment ventures?

Contact us today to discuss your financing needs and discover how our expertise and flexible loan options can help you achieve your goals. Whether you’re a seasoned investor or just starting out, our team at Optimus Capital is here to provide personalized solutions tailored to your unique requirements. Don’t miss out on the chance to unlock your investment potential – reach out to us now and take the first step towards securing the financing you need. Contact us today to explore the possibilities of hard money loans and embark on a successful investment journey.