Flexible Loans for Real Estate Investors in Sacramento California

We at Optimus Capital Inc. work tirelessly so that our borrowers receive the best hard money loan possible.

We have encountered nearly every possible situation and outcome in our deals, therefore we hold a wealth of knowledge and experience to pass on to our real estate investor clients. We offer short and long-term loans in Sacramento, throughout California, and nationwide.

Serving The Investor Community

Optimus Capital, Inc. has flexible loans for real estate investors in Sacramento, California. We have assisted many repeat real estate investor clients in this region obtain investment property financing.

We offer flexible loans in Sacramento, CA. Click the button above and contact our team to find out how you can obtain a hard money loan!

Max Boyko

Full service loans

as a hard money lender in sacramento we offer:

Fix and flip Loan

Rental Portfolio Loans

Rental Loans

Construction Completion

multifamily

Loan

Multifamily loans: Optimus Capital offers both short and long-term funding solutions for the following:

commercial purchases, refinances, and cash-out financing.

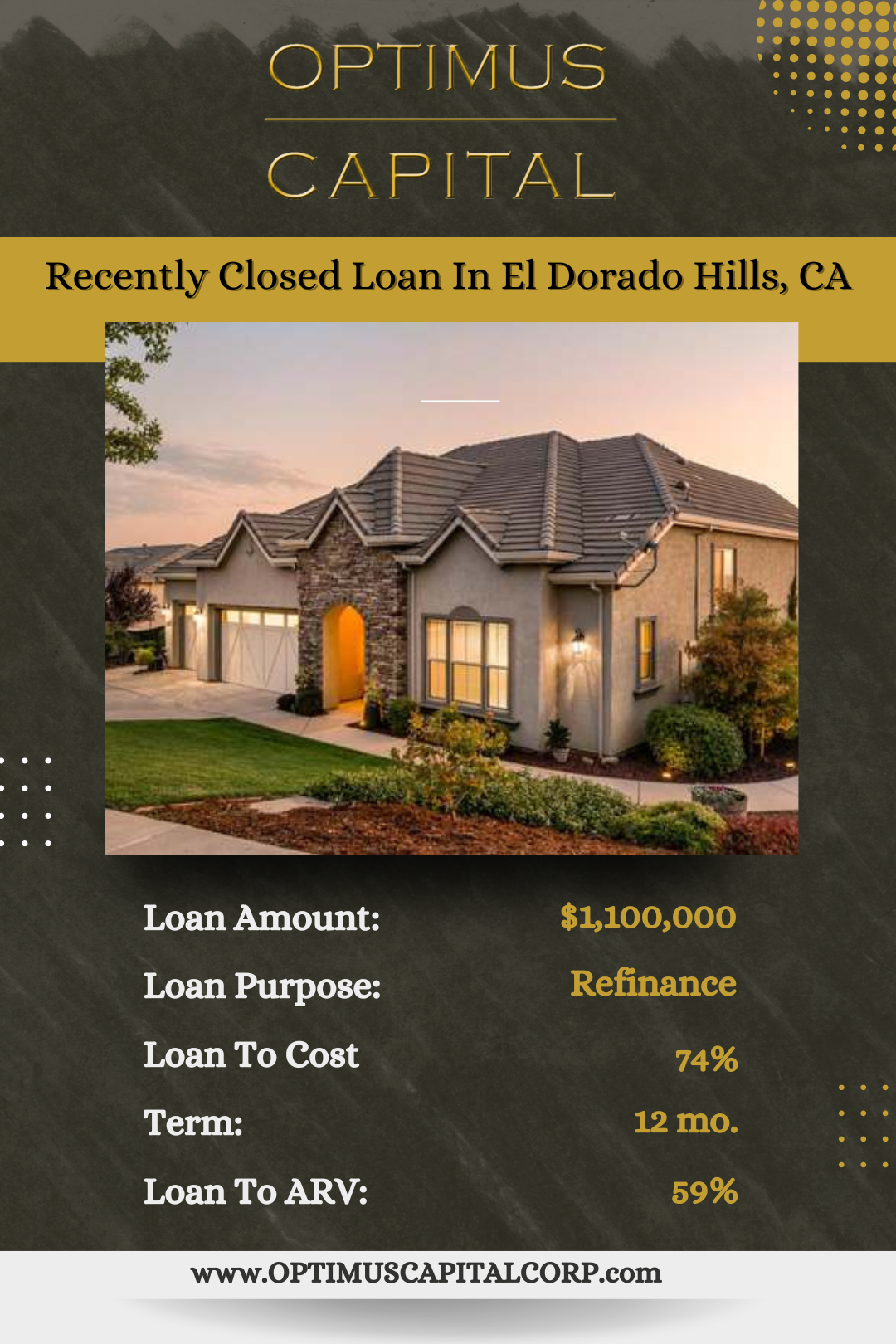

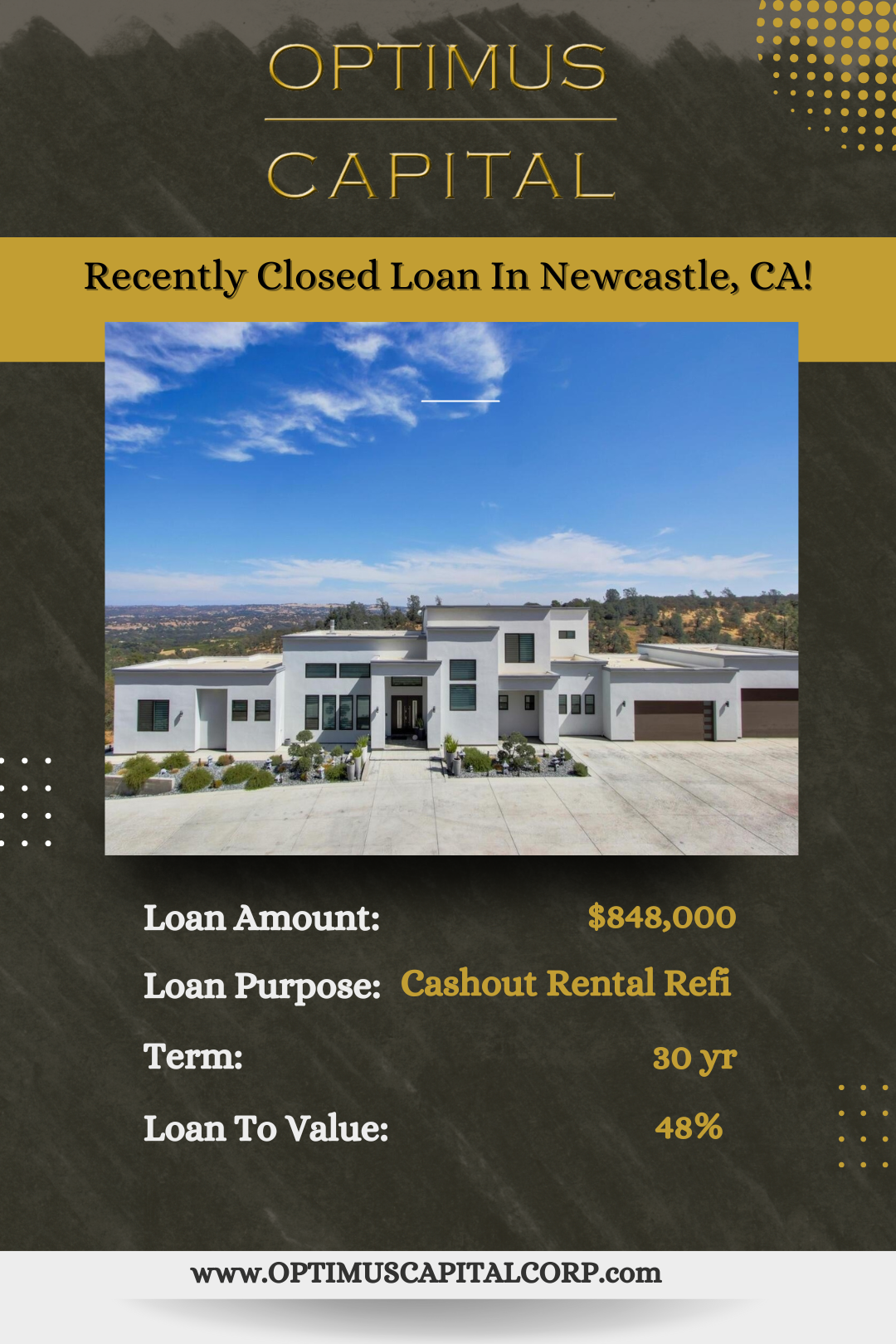

Optimus Capital

Recently Closed Loans

A simple process

Getting A Hard Money Loan In Sacramento, CA

With the typical house price in Sacramento ranging over $350k, it’s critical to have the funds on hand to purchase a property as soon as it becomes available.

A hard money loan can be an excellent alternative to grow your property investments without missing out on your next investment opportunity.

Conventional bank loans are among the financing alternatives available to a person looking to purchase a home.

These loans have their own traditional long-process “red tape” conditions and disadvantages that make obtaining funds quickly hard and time-consuming.

This is exactly why going to a great company in Sacramento, California, such as Optimus Capital Inc, is a great way to access the funds you need to begin your next real estate project. Hard money loans provided by Optimus Capital Inc. are approved faster than conventional financing obtained by institutions.

You can access funding quickly for your next fix and flip, refinance, rental, new construction project, or multi-family/commercial property.

A great reason for hard money loans in Sacramento, California, would be that our loans are simple and quick. You don’t have to lose the next deal that you get into contract because a lender can’t close quickly. We are the solution that you’ve been looking for.

We are a result-oriented company here to serve real estate investors like you, so if you’re in Sacramento searching for Northern California hard money loans or beginning your first fix-and-flip acquisition. We can help!

A local leader

Sacramento, CA

We are one of Sacramento’s most prominent hard money lenders. We run a first-class company. We provide funding for investor real estate transactions, including single-family fix and flip properties, rentals, rental portfolios, new construction spec homes, and more.

Our friendly staff is here to help you close your next transaction and to assist you with obtaining financing for all of your future transactions. Optimus Capital Inc. offers hard money loans across California.

We believe that our customers will succeed in their real estate endeavors when they have a great deal, real estate investor knowledge, and access to quick financing while working with a trustworthy lender.

Contact us, and our team will help you to obtain the financing you need so that you can get started on your next project. Think of us as part of your team that provides Sacramento hard money loans to make your life easier.

Full service loans in more detail

See Below The Types Of Properties In Sacramento California That Are Eligible For A Hard Money Loan

Fix and Flip Houses

If you’re someone who wants to fix and flip houses, this could be the loan for you. It’s not easy to begin in the fix-and-flip industry, and securing capital from traditional lenders for these types of transactions is difficult.

This is why we offer hard money loans for fix and flip SFR single-family properties.

This allows you to purchase, complete the renovation of the property, and finally sell the home which should generate a ROI (return on investment).

Optimus Capital Inc. is positioned to help you finance your next property, remodel it, and even refinance into a long-term rental loan after you renovate the home. It is possible to refinance your original fix and flip loan into a 30-year fixed rental loan. Contact us to find out more about this.

Your trusted partner for commercial real estate financing. We understand the needs of investors who purchase or own commercial properties and are seeking a reliable source of funding. As a leading provider of hard money loans, we specialize in delivering tailored financial solutions to help you seize opportunities and maximize returns on your investments. With our extensive experience in the industry, we offer flexible loan terms, competitive rates, and a streamlined application process. Whether you’re acquiring a new property, refinancing an existing one, or seeking capital for renovations, our team of experts is dedicated to finding the right financing options that align with your goals.

We fund office spaces, such as medical offices, executive suites, and more. We also cater to industrial zones, such as manufacturing facilities, warehouses, and others. Don’t forget about hospitality centers, like hotels and restaurants.

Commercial Property

Residential Properties

- Triplex

- Single-Family Homes

- 4-plex SFR Condo

Hard money loans are the ideal means of paying for real estate quickly. Don’t let the time it takes other companies to examine your credit, look into foreclosures, pry on your marital status, assess your income, and examine your other financial assets hold you back.

If you wait months for a typical loan, you may be disappointed to learn that the property you were trying to buy is no longer available.

Call us today to receive a consultation with one of our sales managers and discuss your hard money loan scenario in Sacramento, CA.

In Closing

Hard Money Loan Approval

With decades of proven experience, our team is prepared to help you achieve your investing goals and secure your hard money.

Specialist Solutions

Conventional financial assistance may turn you down if you have bad credit, a short sale, foreclosures, divorce, bankruptcies, or even your existing employment and salary. We have trust in your ability to succeed in the real estate market. At Optimus Capital Inc. we are specialists at creating solutions in order to provide funding solutions for our client’s transactions. We offer more flexible terms and guidelines than traditional banks. Reach out to our friendly staff now to get started.

Sacramento Hard Money Lender FAQs

Frequently Asked Questions

Hard money lending is a type of short-term financing typically used by real estate investors or individuals who need quick access to capital. It involves borrowing money from private investors or companies that specialize in hard money loans, using the property as collateral.

Testimonials

We’ve helped Hundreds of Property investors in sacramento

Don’t just take our word for it! Check out some of the reviews our clients have left.

Our Raving Fans

Check out the reviews from our satisfied clients

Get Started Now

Optimus Capital Inc. is the Sacramento company that you can count on to get your deal closed. Whether you have a fix and flip, commercial properties, or a mortgage to pay off.

Contact us to refinance your properties whether they be in Sacramento County, the Bay Area, San Francisco County, Los Angeles, or even San Diego we can help!